In today’s digital era, businesses are increasingly moving away from manual processes and embracing online solutions for managing day-to-day tasks. One area that has seen significant transformation is invoice management. Shifting from traditional paper-based systems to managing invoices online can save time, reduce errors, improve cash flow, and streamline operations. Whether you're a small business owner, freelancer, or running a larger operation, online invoicing tools offer many benefits.

In this blog post, we’ll explore the advantages of managing invoices online, the features of online invoicing tools, and tips to choose the best platform for your business.

Why Manage Invoices Online?

-

Increased Efficiency

One of the biggest advantages of managing invoices online is the ability to streamline the invoicing process. Traditional invoicing methods often involve manual data entry, printing, mailing, and waiting for payments. With online invoicing, you can create, send, and track invoices with just a few clicks. This automation significantly reduces time spent on administrative tasks, allowing you to focus on growing your business. -

Faster Payments

Online invoicing systems make it easier for clients to receive and pay invoices promptly. Many platforms allow you to add payment options directly to the invoice, such as credit cards, PayPal, or bank transfers. This seamless integration means your clients can pay you quickly and conveniently, reducing the time you spend waiting for payments. -

Improved Accuracy

Mistakes in invoices, such as incorrect amounts or client details, can delay payments and damage client relationships. Online invoicing tools allow you to automate calculations, reduce human error, and ensure that every invoice is accurate before it’s sent. You can also save client information for repeat invoicing, making the process smoother and error-free. -

Better Cash Flow Management

Keeping track of unpaid invoices can be a challenge when relying on manual methods. Online invoicing platforms give you real-time visibility into which invoices are outstanding, paid, or overdue. Many systems also offer features such as automatic reminders for clients who haven’t paid, helping you manage cash flow and avoid delayed payments. -

Cost Savings

Managing invoices online helps cut down on paper, printing, postage, and storage costs associated with traditional invoicing. It’s also eco-friendly since everything is handled digitally. Over time, these savings can add up and contribute to a more efficient and sustainable business model. -

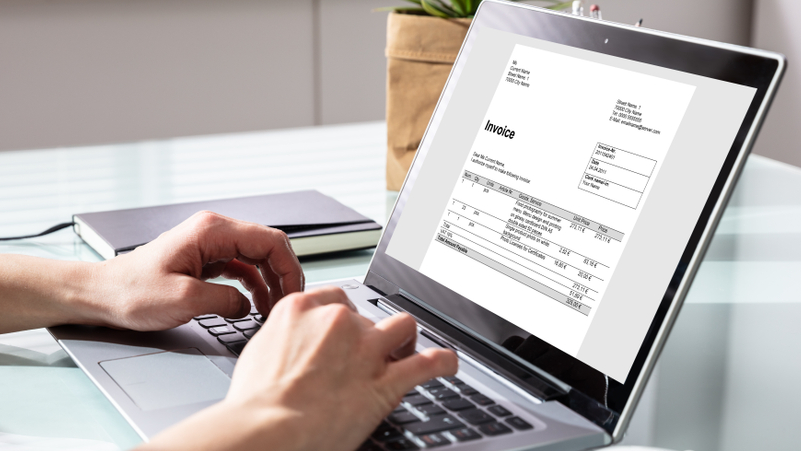

Anywhere, Anytime Access

With online invoicing, you’re no longer tied to your office desk. You can manage your invoices from anywhere with an internet connection, using your computer, tablet, or smartphone. This flexibility is especially beneficial for freelancers, consultants, and businesses that operate remotely or frequently travel.

Key Features of Online Invoicing Tools

When choosing an online invoicing platform, consider the following features to maximize efficiency and ease of use:

-

Customizable Invoice Templates

A good invoicing platform allows you to customize invoice templates to reflect your brand identity. You can add your logo, select colors, and modify the layout to create a professional, cohesive look. -

Recurring Invoices

If you bill clients on a regular basis, look for a tool that supports recurring invoices. This feature automates the creation and sending of invoices for ongoing projects or services, saving you time and ensuring you never miss a billing cycle. -

Payment Integration

The best invoicing tools offer integrated payment gateways, making it easy for clients to pay directly from the invoice. Look for platforms that support multiple payment options, such as credit cards, bank transfers, and digital wallets like PayPal. -

Automated Reminders

Late payments can disrupt cash flow, but manually following up on unpaid invoices takes time. Many online invoicing tools include automated payment reminders that send gentle nudges to clients before and after payment due dates. -

Expense Tracking

Some invoicing platforms also offer expense tracking features, allowing you to log business expenses and link them to client invoices. This is particularly useful for freelancers and contractors who need to bill clients for reimbursable costs. -

Reporting and Analytics

Understanding your invoicing and payment patterns can help you make better financial decisions. Look for an invoicing tool that provides reports on outstanding invoices, revenue, and payment trends, helping you keep track of your business’s financial health. -

Multi-Currency and Tax Support

If your business operates internationally, you’ll need invoicing software that supports multiple currencies and tax regulations. This ensures that your invoices are compliant with local tax laws and that clients can pay in their preferred currency.

Tips for Choosing the Best Online Invoicing Platform

With so many online invoicing solutions available, how do you choose the right one for your business? Here are some tips to guide your decision:

-

Assess Your Business Needs

Consider the size of your business, the volume of invoices you send, and any special features you might need. A freelancer may only need a simple invoicing tool, while a larger business might require more advanced features like expense tracking, reporting, and multiple user accounts. -

Ease of Use

Choose a platform that’s easy to set up and use. An intuitive interface means less time spent figuring out the software and more time focusing on your business. Look for platforms with good customer support in case you run into any issues. -

Scalability

As your business grows, your invoicing needs may change. Opt for a platform that can scale with your business, offering more advanced features as you expand or handle higher invoicing volumes. -

Cost

Most online invoicing platforms offer a variety of pricing plans, ranging from free basic versions to premium options with additional features. Consider your budget and the features you need when choosing a platform. Some platforms also offer free trials, so you can test the tool before committing. -

Security

Invoicing involves sensitive financial information, so make sure the platform you choose has strong security measures in place. Look for tools with data encryption, secure payment gateways, and regular backups to protect your information.

Popular Online Invoicing Tools

Here are some popular online invoicing platforms to consider:

-

FreshBooks: Known for its ease of use, FreshBooks is ideal for small businesses and freelancers. It offers customizable invoices, payment integration, automated reminders, and expense tracking.

-

Wave: A free invoicing solution with robust features, Wave is popular among freelancers and small businesses. It includes customizable templates, recurring billing, and payment processing.

-

QuickBooks: A comprehensive accounting solution that also offers invoicing features, QuickBooks is suitable for small to medium-sized businesses. It supports multi-currency invoicing, tax management, and payment reminders.

-

Zoho Invoice: Zoho Invoice is a scalable platform with customizable templates, multi-currency support, and time-tracking features, making it ideal for growing businesses.

-

Xero: Xero is a full-featured accounting software with strong invoicing capabilities, including customizable templates, recurring invoices, and integrated payments.

Conclusion

Managing invoices online is a smart, efficient way to streamline your business’s financial operations. By reducing manual errors, speeding up payments, and giving you real-time insights into your cash flow, online invoicing can free up valuable time and resources. With the right platform in place, you’ll have more control over your finances and can focus on what truly matters—growing your business.